The Bank of Zambia (BoZ) has outlined its 2025 monetary policy priorities to tackle inflation, support agriculture, and stabilize the Kwacha amid challenges such as drought and global economic pressures.

During the National Symposium on the 2025 Budget on January 21, 2025, BoZ Governor Dr. Denny H. Kalyalya detailed several measures aimed at ensuring economic stability and resilience. These include a reduction in inflation to the medium-term target of 6–8%, support for drought-affected sectors with a K5 billion Stability and Resilience Fund, and maintaining international reserves above three months of import cover.

The Bank of Zambia’s key highlights include:

- Inflation Management:

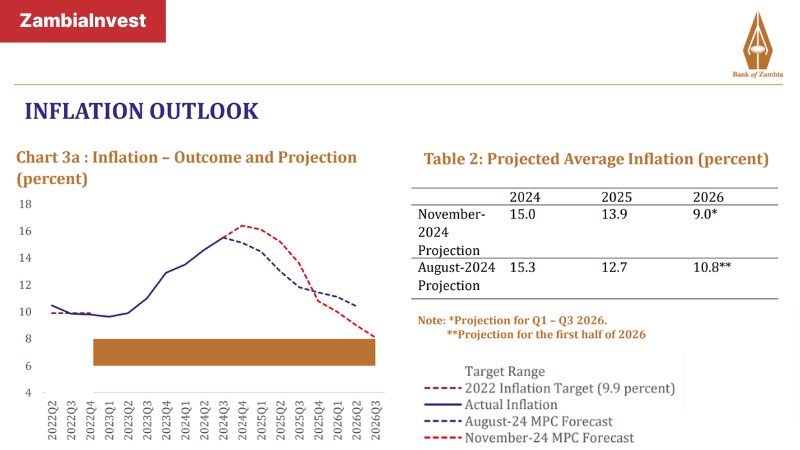

Inflation is projected to decrease from 15.0% in 2024 to 13.9% in 2025 and further to 9.0% in 2026. BoZ aims to achieve this through a combination of tight monetary policy and enhanced financial controls. - Agriculture and Energy Sector Support:

The 2023/24 drought caused a sharp decline in maize production, from 3.3 million metric tonnes in 2023 to 1.5 million metric tonnes in 2024, leading to a 45.7% year-on-year increase in maize prices. To address this, the BoZ introduced a K5 billion fund to stabilize and support affected sectors. - Exchange Rate Stabilization:

The Kwacha depreciated by 7% in 2024 to close the year at K27.58 per USD. BoZ plans to mitigate these pressures through demand-supply management and maintaining international reserves at $4.1 billion (4.4 months of import cover as of November 2024). - Export Proceeds Tracking Framework:

Launched in 2024, this framework recorded $7.7 billion in export earnings processed through local banks. BoZ plans to expand the system in 2025 to include imports and services for comprehensive data. - Digital Economy Support:

To promote a 24-hour economy, the Real-Time Gross Settlement (RTGS) system’s operating hours have been extended on a six-month pilot basis. - Regulatory Updates:

Currency directives to strengthen the Kwacha’s role as legal tender will be issued in Q1 2025. The National Payment Systems Act of 2017 will be replaced to align with advancements in financial technologies. A Deposit Protection Fund is also being operationalized to safeguard deposits.

Dr. Kalyalya emphasized the importance of these measures, stating: “The 2025 monetary policy framework reflects our commitment to ensuring economic stability and resilience in the face of ongoing challenges. We are focused on reducing inflation, stabilizing the exchange rate, and supporting sustainable growth.”